top of page

What You Need to Know About the Accelerated and Reformed Right-of-Way (ARROW) Act (RA 12289)

(c) ABS-CBN News On September 12, 2025, President Ferdinand “Bongbong” Marcos Jr. signed into law Republic Act No. 12289 , also known as the Accelerated and Reformed Right-Of-Way (ARROW) Act . Sponsored by Sen. Mark Villar, the ARROW Act aims to streamline, modernize, and accelerate right-of-way (ROW) acquisition for national infrastructure projects—while ensuring fair, transparent, and equitable compensation for affected landowners. The law updates and amends key provision

Yasser Aureada

Dec 1, 20252 min read

BIR Suspends All Audits Under RMC 107-2025: What Businesses and Taxpayers Must Do Now

(As of November 24, 2025) The Bureau of Internal Revenue (BIR) has issued Revenue Memorandum Circular (RMC) No. 107-2025 , ordering a full suspension of all tax audits and field operations nationwide . This unprecedented move marks one of the most significant tax administration shifts in recent Philippine history. Businesses are now asking: How does this affect my ongoing audit, tax exposure, or next compliance cycle? If you are a corporate taxpayer, SME, professional, or ind

Yasser Aureada

Nov 24, 20253 min read

New Leadership at the BIR: What It Means for Taxpayers & Businesses

The tax landscape in the Philippines is seeing a major shift: Charlito Martin R. Mendoza has been announced as the new Commissioner of the Bureau of Internal Revenue (BIR) , replacing Romeo “Jun” Lumagui Jr. For businesses, taxpayers, and tax professionals, this is a development worth monitoring. As a leading CPA-law firm, Aureada CPA Law Firm examines who Commissioner Mendoza is, the context behind this leadership change, and its possible implications for compliance, audit

Yasser Aureada

Nov 12, 20253 min read

SEC’s New Audit Exemption for MSMEs: Compliance Cost Savings and Impact

Micro, small, and medium enterprises (MSMEs) are the backbone of the Philippine economy. Recognizing their importance, the Securities and Exchange Commission (SEC) has proposed a major policy change to ease regulatory burdens — allowing more corporations to be exempt from filing audited financial statements. This initiative aims to reduce compliance costs and support the government’s broader goal of driving inclusive economic development. The SEC’s proposal, detailed in its p

Yasser Aureada

Nov 4, 20253 min read

SEC’s Proposed Interest Rate Cap: What It Means for Lenders and Borrowers

The Securities and Exchange Commission (SEC) is moving to implement stricter limits on the interest rates and fees charged by lending and financing companies in the Philippines. This initiative is part of its intensified campaign to curb predatory lending while ensuring the sustainability of legitimate financial institutions. Key Highlights of the Proposal Under the draft circular on Recalibrated Ceilings on Interest Rates and Other Fees , the SEC proposes new rules for unsec

Yasser Aureada

Nov 3, 20253 min read

DOF and BIR Propose Higher Tax-Exempt “De Minimis” Benefits for Workers

The Department of Finance (DOF) and the Bureau of Internal Revenue (BIR) have recently submitted proposals to increase the ceilings for tax-exempt de minimis benefits granted to employees. These are small-value benefits that employers provide — such as rice subsidies, uniform allowances, or medical assistance — which remain exempt from income tax up to prescribed limits. The proposal seeks to update those limits in recognition of the rising cost of living, inflation, and the

Yasser Aureada

Oct 27, 20253 min read

BIR Extends Compliance Period for Electronic Invoicing — What Businesses Need to Know

The Bureau of Internal Revenue (BIR) has issued Revenue Regulations (RR) No. 26-2025 , dated September 5, 2025, amending the transitory provisions of RR No. 11-2025. This latest issuance formally extends the compliance period for the implementation of electronic invoicing (EIS) until December 31, 2026 . Under RR No. 11-2025, taxpayers covered by Sections 237 and 237-A of the National Internal Revenue Code (NIRC), as amended by Republic Act No. 12066, were originally given one

Yasser Aureada

Oct 20, 20253 min read

A One-Month Income Tax Holiday? What Filipino Employees Should Know

What’s Being Talked About? Senator Erwin Tulfo publicly floated the idea of a one-month income tax holiday for employees , framed as...

Yasser Aureada

Oct 12, 20252 min read

A New Era of E-Filing: Supreme Court Issues 2025 Transitory Rules on Electronic Filing and Service

The Supreme Court of the Philippines has approved the 2025 Transitory Rules on Electronic Filing and Service in the Supreme Court (A.M....

Yasser Aureada

Oct 7, 20253 min read

Navigating the 2025 SEC Guidelines on the Philippine Green Equity Label

The Philippine Securities and Exchange Commission (SEC) recently issued Memorandum Circular No. 13, Series of 2025, establishing the...

Yasser Aureada

Sep 30, 20253 min read

Supreme Court Clarifies VAT Incentive for Domestic Businesses Under CREATE Act

(c) Rappler The Philippine Supreme Court has ruled that domestic businesses are entitled to the same value-added tax (VAT) incentives as...

Yasser Aureada

Sep 29, 20252 min read

SEC Grants Group C Accreditation to Aureada CPA Law Firm

Date of Approval: September 18, 2025 Accredited Partner: Atty. Yasser Ramos Aureada, CPA Accreditation Overview We are pleased to...

Yasser Aureada

Sep 23, 20252 min read

Key Compliance Requirements Under the 2025 SEC CASP Rules in the Philippines

Introduction In 2025, the Securities and Exchange Commission (SEC) issued the Crypto-Asset Service Provider (CASP) Rules to regulate...

Yasser Aureada

Sep 18, 20252 min read

Understanding the BIR Electronic Invoicing System (EIS) in the Philippines

The Bureau of Internal Revenue (BIR) has rolled out its Electronic Invoicing/Receipting System (EIS) as part of the government’s push for...

Yasser Aureada

Sep 15, 20253 min read

SEC Memorandum Circular No. 11 (2025): Updated Guidelines on Exempt Transactions in the Philippines

On September 9, 2025, the Securities and Exchange Commission (SEC) issued Memorandum Circular No. 11, Series of 2025, introducing further...

Yasser Aureada

Sep 15, 20252 min read

Understanding DAO No. 25-12: The New Rules on E-Commerce Trustmark in the Philippines

The Department of Trade and Industry (DTI) recently issued Department Administrative Order (DAO) No. 25-12, Series of 2025, which serves...

Yasser Aureada

Sep 14, 20253 min read

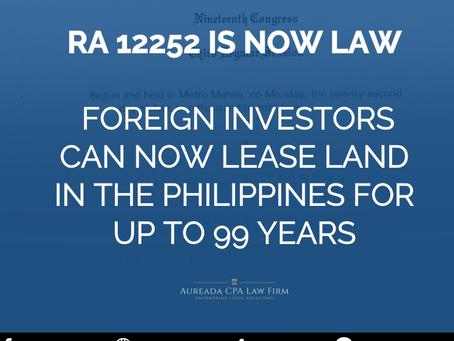

RA 12252: What Foreign Investors Need to Know About the New 99-Year Land Lease Law

On September 3, 2025, President Ferdinand R. Marcos Jr. signed into law Republic Act No. 12252, which amends the Investors’ Lease Act (RA...

Yasser Aureada

Sep 12, 20253 min read

E-Governance Act of 2025: What Every Filipino Should Know

(c) PCO On September 5, 2025, President Ferdinand R. Marcos, Jr. signed into law Republic Act No. 12254, also known as the E-Governance...

Yasser Aureada

Sep 11, 20253 min read

Understanding the Anti-Financial Account Scamming Act (AFASA).

Protecting Financial Accounts in the Digital Age With the rise of online banking, e-wallets, and digital payments, financial scams have...

Yasser Aureada

Sep 7, 20253 min read

Spotting Red Flags in Government Projects: A Citizen’s Guide

Public infrastructure projects — from flood control systems to roads and bridges — are built using taxpayer funds. While the law provides...

Yasser Aureada

Sep 7, 20253 min read

bottom of page